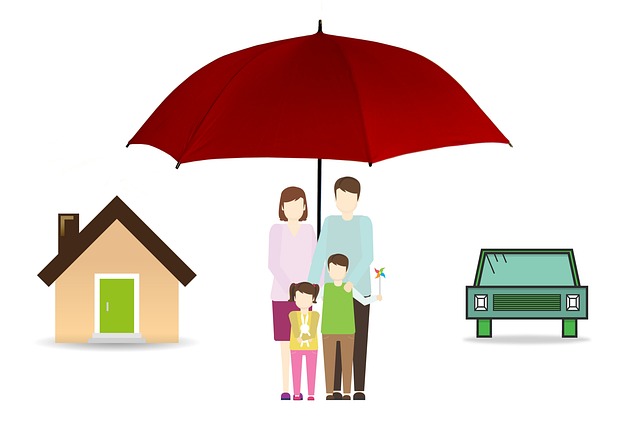

Life Cover in South Africa is a crucial financial tool offering peace of mind and support for beneficiaries in case of the insured's death. It covers debts like mortgages and personal loans, ensuring loved ones' financial stability. In a country with economic uncertainty and high living costs, life insurance provides protection against unforeseen events, helping families manage debt and plan for the future. By understanding tailored Life Cover options, South Africans can secure their financial future and ensure their loved ones are shielded from financial burdens.

In South Africa, where financial unpredictability is a constant companion, understanding Life Cover is more than just an insurance policy—it’s a safety net. This comprehensive guide delves into the critical role of Life Cover in South Africa, exploring why it’s an essential tool for managing debt and ensuring financial stability. We’ll uncover its significance in repaying loans, mortgages, and personal debts, providing insights on choosing the right policy to fit individual needs. Discover how the importance of life insurance in South Africa can lead to a secure future free from financial burdens.

- Understanding Life Cover in South Africa: A Comprehensive Guide

- The Financial Safety Net: Why Life Insurance is Crucial for South Africans

- Debt Repayment Strategies and the Role of Life Cover

- Benefits of Life Insurance in Managing Personal Loans and Mortgages

- Choosing the Right Life Cover Policy: Considerations for South African Residents

- Real-Life Scenarios: How Life Insurance Can Facilitate Debt Freedom

Understanding Life Cover in South Africa: A Comprehensive Guide

Life Cover in South Africa is a crucial component of financial planning for many individuals and families. It plays a pivotal role in debt repayment strategies, ensuring that beneficiaries receive financial support in the event of an insured individual’s passing. This type of insurance is designed to provide a safety net, covering outstanding debts such as mortgages, personal loans, and other financial obligations. In a country like South Africa, where the cost of living can be high, having Life Cover offers peace of mind and helps maintain financial stability for loved ones left behind.

The Importance of Life Insurance in South Africa is multifaceted. Not only does it offer protection against unforeseen circumstances, but it also enables individuals to plan for their family’s future. In many cases, life insurance policies can be tailored to meet specific needs, including covering education fees or business expenses. With a comprehensive understanding of Life Cover options available in South Africa, individuals can make informed decisions about their financial security and that of their loved ones.

The Financial Safety Net: Why Life Insurance is Crucial for South Africans

In South Africa, where economic uncertainty and high living costs can make financial stability a constant challenge, having a robust financial safety net is more important than ever. This is where Life Cover in South Africa steps in as a crucial component of personal financial planning. It provides a safety net for individuals and their families, ensuring that even in the event of an unforeseen tragedy, there is financial protection against mounting debts and other financial obligations.

The Importance of Life Insurance in South Africa lies not just in its ability to repay outstanding debts, but also in offering peace of mind. With life insurance, policyholders can be confident that their loved ones will be taken care of financially if they are no longer able to provide. This is especially vital given the high cost of living and the prevalence of personal debt across the country. By ensuring a safety net for one’s family, life insurance enables South Africans to focus on living fully, knowing that their financial future is secure.

Debt Repayment Strategies and the Role of Life Cover

In the context of South Africa’s financial landscape, effective debt repayment strategies are essential for individuals and families aiming to secure their future. Among various tools available, Life Cover plays a pivotal role in managing and reducing debt burdens. The Importance of Life Insurance in South Africa cannot be overstated, as it provides a safety net that can significantly ease the financial strain on beneficiaries during challenging times.

When integrated into a comprehensive debt repayment plan, Life Cover ensures that outstanding debts are settled according to pre-determined terms, even if the policyholder faces unforeseen circumstances such as illness or untimely death. This not only offers peace of mind but also allows for more strategic repayment approaches, enabling individuals to prioritize high-interest debts and avoid defaulting on essential financial obligations.

Benefits of Life Insurance in Managing Personal Loans and Mortgages

In the vibrant and bustling landscape of South Africa, managing personal finances is a crucial aspect of life. For those with personal loans or mortgages, Life Cover plays a pivotal role in debt repayment strategies. The importance of Life Insurance in South Africa cannot be overstated; it offers peace of mind and financial security to individuals and their families. By ensuring that outstanding debts are settled in the event of unforeseen circumstances, Life Cover acts as a safety net, safeguarding one’s financial well-being.

This type of insurance provides a structured way to navigate the complexities of debt repayment. In the event of a policyholder’s passing, the death benefit can be used to pay off loans or mortgages, preventing the burden from falling solely on the family. This proactive approach ensures that individuals can rest easy, knowing their financial obligations are managed, even in the face of life’s uncertainties, fostering stability and security within their households.

Choosing the Right Life Cover Policy: Considerations for South African Residents

When considering a life cover policy in South Africa, several factors come into play. It’s crucial to assess your individual needs and circumstances, as well as the broader financial landscape of the country. In a nation where the cost of living is high and economic uncertainty persists, having adequate life insurance becomes paramount. The right life cover policy can provide peace of mind, ensuring that your loved ones are financially secured in case of the unexpected.

South African residents should look for policies tailored to their unique situation. This includes evaluating the type of coverage needed – whether it’s term life, whole-life, or a combination – and determining the level of protection required to repay debts. Additionally, understanding the policy’s terms, exclusions, and benefits is essential. Comparing different providers and their offerings can help in selecting a policy that aligns with individual financial goals and offers valuable protections, underlining the importance of life insurance in South Africa.

Real-Life Scenarios: How Life Insurance Can Facilitate Debt Freedom

In real-life scenarios, life insurance plays a pivotal role in helping South Africans achieve financial freedom from debt. Consider a family with a primary earner who suddenly passes away. Without adequate Life Cover in South Africa, the surviving spouse may struggle to make ends meet, especially if they are burdened by outstanding debts. However, with comprehensive Life Insurance, the proceeds can be used to settle these debts, providing much-needed financial relief and stability. This ensures that the family’s well-being is protected, even in the face of adversity.

The Importance of Life Insurance in South Africa extends beyond individual cases. For many, it’s a safety net during challenging economic times. Whether facing medical emergencies, unexpected job losses, or rising living costs, life insurance can help maintain financial security and prevent debt accumulation. By ensuring that outstanding debts are settled upon the insured person’s passing, it offers peace of mind and prevents a potential financial crisis for loved ones left behind.

In conclusion, life cover plays a pivotal role in debt repayment and financial security for South Africans. Understanding the importance of life insurance and choosing the right policy can provide a safety net, ensuring that personal loans and mortgages are repaid even in the event of unforeseen circumstances. The benefits of life cover extend beyond peace of mind; it actively facilitates debt freedom by offering protection against financial setbacks, ultimately empowering individuals to live free from debt’s burden.