In South Africa, Life Cover is an essential tool for financial planning, providing crucial protection and peace of mind for families. It ensures dependents are financially secure, covering funeral expenses, daily living costs, and education needs. Choosing the right life insurance involves understanding various types like whole-life and term life policies, comparing quotes, and selecting a reputable insurer to secure your family's financial future.

“Discovering the best Life Cover in South Africa can be a complex task. This comprehensive guide breaks down everything you need to know about life insurance in this vibrant nation. From understanding the basics and exploring various types to highlighting the importance of life insurance for South Africans, we provide key insights. Learn how to navigate the options and choose the right Life Cover tailored to your needs, ensuring peace of mind and financial security for you and your loved ones.”

- Understanding Life Cover in South Africa: Basics and Types

- Why Life Insurance is Crucial for South Africans: Key Benefits

- Choosing the Right Life Cover: A Comprehensive Guide for South African Residents

Understanding Life Cover in South Africa: Basics and Types

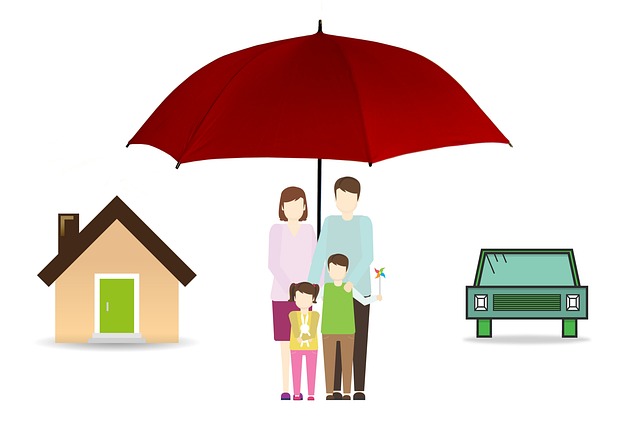

In South Africa, Life Cover plays a pivotal role in financial planning and security. It is a crucial tool to protect one’s loved ones and ensure their financial well-being in the event of an unfortunate occurrence. Simply put, Life Cover provides a financial safety net for your family, helping them manage expenses and maintain their lifestyle if you suddenly pass away. This type of insurance offers peace of mind, knowing that your dependents are taken care of financially.

There are various types of Life Insurance in South Africa to suit different needs. The most common forms include whole-life cover, which guarantees a payout for the policyholder’s entire life, and term life cover, offering protection for a specified period. Other options may include critical illness cover, which pays out if the policyholder is diagnosed with a covered critical illness, and income protection insurance, designed to replace a portion of your income if you become unable to work due to illness or injury. Understanding these options is essential when choosing the right Life Cover in South Africa for your circumstances.

Why Life Insurance is Crucial for South Africans: Key Benefits

Life insurance is a vital component of financial planning for South Africans, offering a safety net that can protect against unforeseen circumstances and provide peace of mind. Given the country’s economic landscape, where job security can be volatile, life cover in South Africa serves as a crucial safety measure for families. It ensures that dependents are financially supported if the primary breadwinner passes away, covering funeral expenses, daily living costs, and even future education needs.

The importance of life insurance in South Africa extends beyond individual protection; it contributes to the overall economic stability of households. By insuring against life’s risks, policyholders can safeguard their assets, avoid debt traps, and maintain a sense of security. This is especially relevant for those with mortgages or other financial obligations that would otherwise be burdened by unexpected losses.

Choosing the Right Life Cover: A Comprehensive Guide for South African Residents

Choosing the right life cover in South Africa is a crucial decision that requires careful consideration of your financial situation and future goals. The importance of life insurance in South Africa cannot be overstated, as it provides financial security for your loved ones in case of your untimely departure. Start by understanding your needs: determine how much coverage you require to support your family’s lifestyle and outstanding debts. Consider factors like mortgage payments, education expenses, and daily living costs.

Next, evaluate different types of life cover available, such as whole-of-life insurance, term life insurance, or a combination of both. Whole-of-life plans offer lifelong coverage but usually come with higher premiums, while term life provides coverage for a specific period at a lower cost. Compare quotes from various insurers and read the policy documents thoroughly to understand what is covered and what exclusions apply. Additionally, ensure the insurer has a solid reputation and financial stability to guarantee claim payments when needed.

In conclusion, securing life cover in South Africa is a vital step towards safeguarding your loved ones’ financial wellbeing. Understanding the different types and benefits of life insurance is essential, especially given the unique challenges South Africans face. By following this comprehensive guide, you can make an informed decision when choosing the right life cover plan to suit your needs, ensuring peace of mind for both you and your family in these uncertain times. The importance of life insurance in South Africa cannot be overstated; it’s a responsible step towards securing a brighter future.