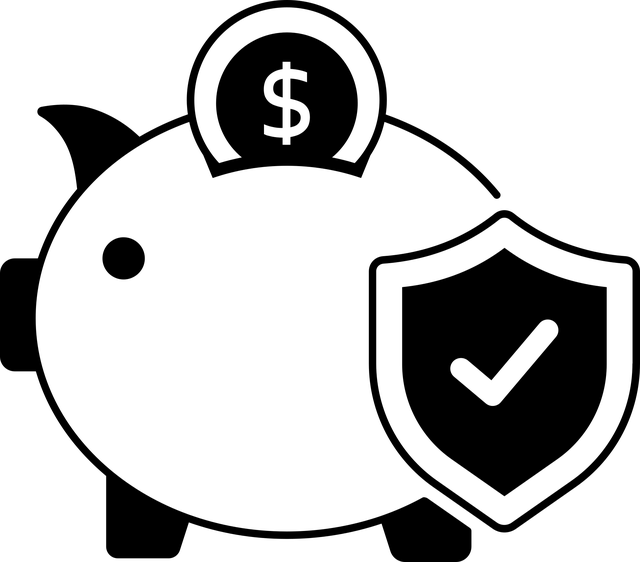

In South Africa, Life Cover is an essential tool for debt management and financial security. This policy provides a lump-sum payment upon death or disability, enabling beneficiaries to settle debts like mortgages and personal loans without immediate repayment pressure. Given the high cost of living and financial uncertainties, Life Cover offers peace of mind and ensures families are protected from financial turmoil during difficult times. Local financial institutions often incorporate Life Cover into loan packages, emphasizing its significance in South Africa's dynamic financial landscape.

In South Africa, where financial instability can strike unexpectedly, Life Cover plays a pivotal role in debt repayment and financial security. This comprehensive guide delves into the intricate workings of Life Cover within the unique South African landscape. We explore how this safety net facilitates smooth debt management, offering peace of mind and financial stability for individuals and their families. Understanding Life Cover is essential for every South African seeking to secure their legacy and safeguard against unforeseen circumstances.

- Understanding Life Cover in South Africa: A Comprehensive Overview

- How Life Cover Facilitates Debt Repayment: The Financial Safety Net

- Benefits and Importance of Life Cover for South Africans: Securing Your Legacy

Understanding Life Cover in South Africa: A Comprehensive Overview

In South Africa, Life Cover is a crucial financial tool designed to protect individuals and their families from unexpected events. It provides a safety net by ensuring that outstanding debts are settled in the event of death or disability, offering peace of mind and financial security. This comprehensive overview aims to demystify Life Cover in the context of South African debt repayment strategies.

Understanding Life Cover involves grasping its key functionalities. It is an insurance policy that offers a lump-sum payment upon the insured individual’s passing or if they become disabled. This payout can be used to settle various debts, including mortgages, personal loans, and outstanding bills. In South Africa, where the cost of living is high and financial uncertainties are prevalent, Life Cover becomes a vital component in managing debt obligations, ensuring that loved ones are not burdened with repayment responsibilities during challenging times.

How Life Cover Facilitates Debt Repayment: The Financial Safety Net

Life Cover plays a pivotal role in facilitating debt repayment for many South Africans, offering a much-needed financial safety net. In a country where the cost of living is high and unemployment rates remain persistently high, having protection against unforeseen circumstances is essential. When individuals take out Life Cover, they ensure that their loved ones are financially secure in case of their passing. This security translates into peace of mind for the policyholder, knowing that outstanding debts, such as mortgages or personal loans, can be repaid without placing a strain on their family’s finances.

The safety net provided by Life Cover ensures that debt repayment becomes more manageable, often with additional benefits like tax advantages. Many South African financial institutions offer life assurance as part of loan packages, highlighting its importance in the local financial landscape. With the right Life Cover plan, individuals can protect their families from falling into financial turmoil and ensure that debts are settled without causing further distress during an already challenging time.

Benefits and Importance of Life Cover for South Africans: Securing Your Legacy

In the vibrant and bustling landscape of South Africa, securing one’s financial future is paramount. Life cover plays a crucial role in this regard, offering individuals a safety net that protects not just their assets, but also their legacy. This essential insurance mechanism ensures that in the event of unforeseen circumstances, your loved ones are provided for, with peace of mind knowing your debts will be repaid and your family’s financial stability maintained.

For South Africans navigating complex financial landscapes, life cover is more than just an investment; it’s a testament to caring for one’s own. It revolutionizes the way individuals approach debt repayment, enabling them to safeguard their hard-earned progress and leave behind a lasting impact. By prioritizing life cover, folks can ensure their stories aren’t defined by financial burdens but rather by the indelible marks they leave on their families’ lives.

Life Cover plays a pivotal role in financial security, especially for South Africans navigating debt repayment. By providing a safety net, it ensures that outstanding debts are settled upon an individual’s passing, offering peace of mind and protecting loved ones from the burden of financial stress. Embracing Life Cover is a proactive step towards securing one’s legacy and safeguarding against unforeseen circumstances, making it an indispensable consideration for South Africans seeking to safeguard their future and that of their families.