The text emphasizes the importance of funeral cover (life insurance) as a financial safety net for loved ones after death. It guides individuals to consult an insurance broker who helps navigate various options, compare insurance quotes, and choose suitable life cover insurance based on family needs. Reputable insurance companies offer different types of life insurance policies, and brokers assist in selecting the right life covers, ensuring financial security for families post-loss. Key considerations include annuity types, insurer reputation, insurance quotes comparison, policy terms, and aligning coverage with beneficiaries' requirements.

Planning a funeral can be emotionally challenging, but securing the right life cover ensures your loved ones are protected financially. In this comprehensive guide, we’ll explore the essential aspects of funeral cover, including its role in supporting families during difficult times. We’ll delve into how an insurance broker can simplify the process and connect you with top insurance companies offering tailored solutions. Additionally, we’ll provide insights on choosing the best life cover insurance policy, tips for obtaining accurate life insurance quotes, and the significant benefits of life cover for parents.

- Understanding Funeral Cover: A Comprehensive Guide

- The Role of an Insurance Broker in Your Funeral Planning

- Top Insurance Companies Offering Funeral Cover Solutions

- Unlocking the Benefits: Life Cover for Parents and Families

- Comparing Life Cover Insurance Policies: What to Look For

- Obtaining Accurate Life Insurance Quotes: A Step-by-Step Process

Understanding Funeral Cover: A Comprehensive Guide

Understanding Funeral Cover: A Comprehensive Guide

Funeral cover, also known as life cover for parents or life insurance policy, is a crucial financial safety net designed to protect your loved ones during their time of grief and economic strain following your passing. It serves as an annuity, providing a lump-sum payment to help offset the immediate financial burden associated with funeral expenses, outstanding debts, and other related costs. By consulting with an insurance broker, you can explore various life cover insurance options from reputable insurance companies to find the best fit for your family’s needs.

Obtaining life insurance quotes allows you to compare different plans and their corresponding premiums, helping you make an informed decision. These quotes offer transparency in terms of coverage amounts and policy conditions. Whether you’re looking for whole life insurance or term life insurance, a comprehensive guide like this one will walk you through the process, ensuring you select the most suitable life covers based on your financial goals and the well-being of your parents or loved ones.

The Role of an Insurance Broker in Your Funeral Planning

When planning for your final sentiments, an insurance broker can play a vital role in ensuring you have the appropriate life cover, commonly known as funeral cover or life insurance. They act as intermediaries between you and various insurance companies, helping to navigate the often complex world of annuities and life policies. An expert broker will assess your needs and financial situation, considering factors such as age, health, and desired level of coverage for your loved ones.

They then source tailored life cover quotes from multiple insurers, providing you with a comprehensive comparison. This allows you to make an informed decision on the best life insurance policy, ensuring your family is protected financially during an emotionally challenging time. An insurance broker’s knowledge and experience can be invaluable in securing the right level of life cover for parents or other loved ones, offering peace of mind during what can be a difficult period.

Top Insurance Companies Offering Funeral Cover Solutions

When considering funeral cover options, it’s essential to explore the offerings from reputable insurance companies. Top-tier insurers provide comprehensive life cover for parents and other family members, ensuring financial security during an emotionally challenging time. These companies offer a range of life insurance policy types, including annuities, tailored to individual needs.

An experienced insurance broker can assist in navigating these options, providing valuable insights into different life cover insurance quotes and helping you compare benefits. This expert guidance is crucial when selecting the right life covers, ensuring you secure the best value for your investment while covering all necessary bases with a suitable life insurance policy.

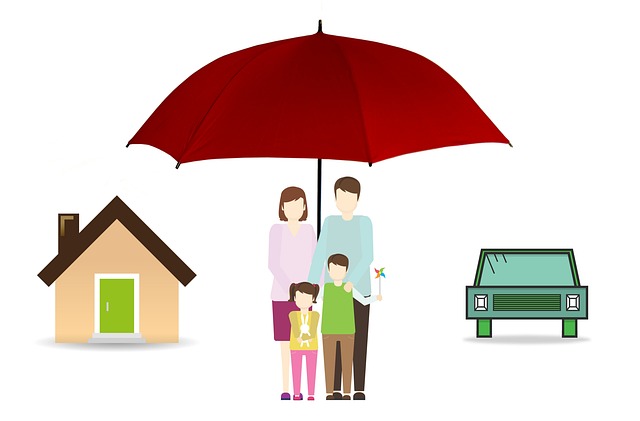

Unlocking the Benefits: Life Cover for Parents and Families

Unlocking the Benefits: Life Cover for Parents and Families

For parents, ensuring the financial security of their loved ones is a top priority, especially in the unfortunate event of their passing. This is where life cover insurance steps in as a powerful tool to safeguard families and provide them with peace of mind. By purchasing a life insurance policy, parents can leave behind a valuable annuity that will support their dependents for years to come. Insurance brokers play a crucial role in this process by offering guidance and access to various life cover options from leading insurance companies.

With just a few simple steps and a request for insurance quotes, parents can secure life covers tailored to their specific needs. Life insurance policies provide a safety net, ensuring that financial obligations and day-to-day expenses are met, allowing families to focus on healing and recovery during difficult times. Whether it’s paying off mortgages, funding education, or simply providing a comfortable standard of living, life cover for parents is an investment in the well-being of one’s family.

Comparing Life Cover Insurance Policies: What to Look For

When comparing life cover insurance policies, it’s crucial to consider various factors that align with your unique needs and budget. Start by evaluating the type of annuity offered, as this will determine how your benefits are paid out post-death. Some annuities provide a lump-sum payment, while others offer regular income streams. Next, assess the reputation and financial strength of insurance companies through independent rating agencies. This step is vital to ensuring stability and claims payout capabilities.

Additionally, obtain life cover quotes from multiple insurers through an insurance broker to compare coverage amounts, premiums, and inclusions. Life cover for parents or any individual should include a death benefit sufficient to cover funeral expenses and outstanding debts without straining beneficiaries’ finances. Carefully review the terms and conditions of each life insurance policy, paying attention to exclusions, waiting periods, and renewal options to make an informed decision that provides adequate life covers.

Obtaining Accurate Life Insurance Quotes: A Step-by-Step Process

Obtaining accurate life insurance quotes is a vital step in ensuring your loved ones are protected financially should the unexpected occur. The process involves several key steps that can help you make an informed decision. Firstly, define your needs by determining the type of life cover for parents or life covers that best suits your situation – whether it’s a whole life insurance policy, term life, or an annuity.

Next, shop around and compare insurance quotes from various insurance companies. Speak to an insurance broker who can guide you through the options available, considering factors like your age, health history, and desired coverage amount. This comparison will help you understand the costs associated with different life insurance policies, enabling you to find the best balance between affordability and comprehensiveness.

In light of the above discussions, it’s clear that funeral cover is a vital component of comprehensive financial planning, especially when considering life cover for parents and families. When choosing a life insurance policy or obtaining life insurance quotes, remember to assess the reputation of top insurance companies and the expertise of an insurance broker to ensure you’re making an informed decision. By understanding your options and comparing life cover insurance policies, you can unlock the benefits of an annuity that provides peace of mind during what can be a challenging time for families.